2024 Hybrid Cars Tax Credit – The federal tax credit rules for electric vehicles often change, as they did on January 1, 2024. The good news is the tax credit is now easier to access. The bad news is fewer vehicles now qualify for . If you’ve been thinking of buying a new hybrid or electric car, truck or van, you’ll be happy to see that the federal government has published updated rules for tax credits on electric vehicles. .

2024 Hybrid Cars Tax Credit

Source : www.npr.orgIRS Moves to Make EVs, Plug In Hybrids Immediately Eligible for

Source : rbnenergy.comEV tax credits 2024: VERIFY Fact Sheet | verifythis.com

Source : www.verifythis.comEvery electric vehicle that qualifies for federal tax credits in 2024

Source : electrek.coOnly 13 Cars Qualify For 2024 EV Tax Credit Under New Rules

Source : www.bloomberg.comElectric Vehicles: EV Taxes by State: Details & Analysis

Source : taxfoundation.org2022 EV Tax Credits from Inflation Reduction Act Plug In America

Source : pluginamerica.orgEV tax credit

Source : smithpatrickcpa.comThe (Pretty Short) List of EVs That Qualify for a $7,500 Tax

Source : insideclimatenews.orgThe $7,500 tax credit for electric cars is about to change yet

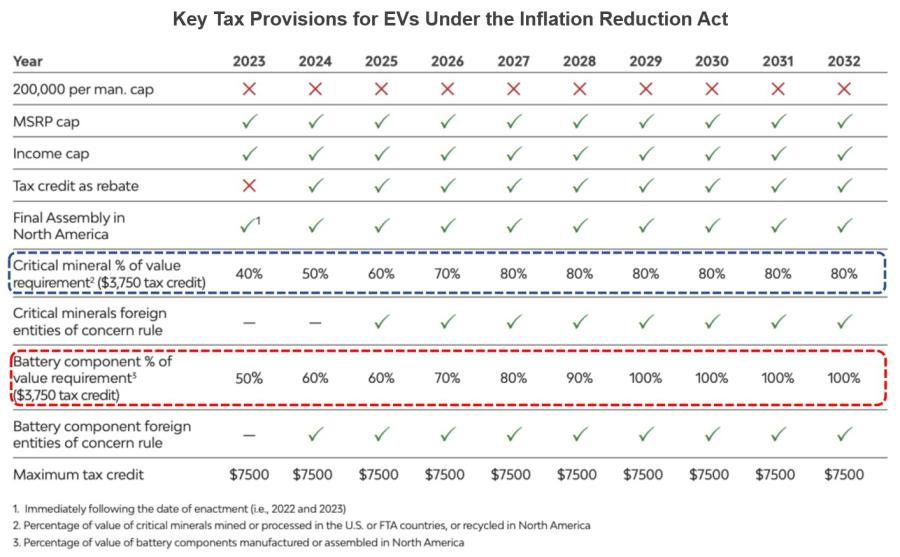

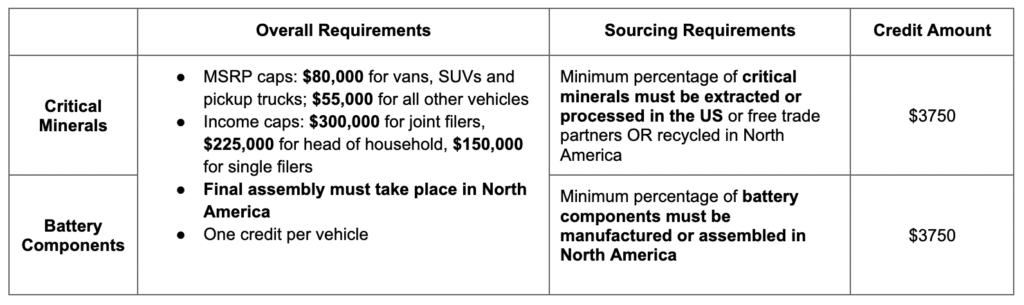

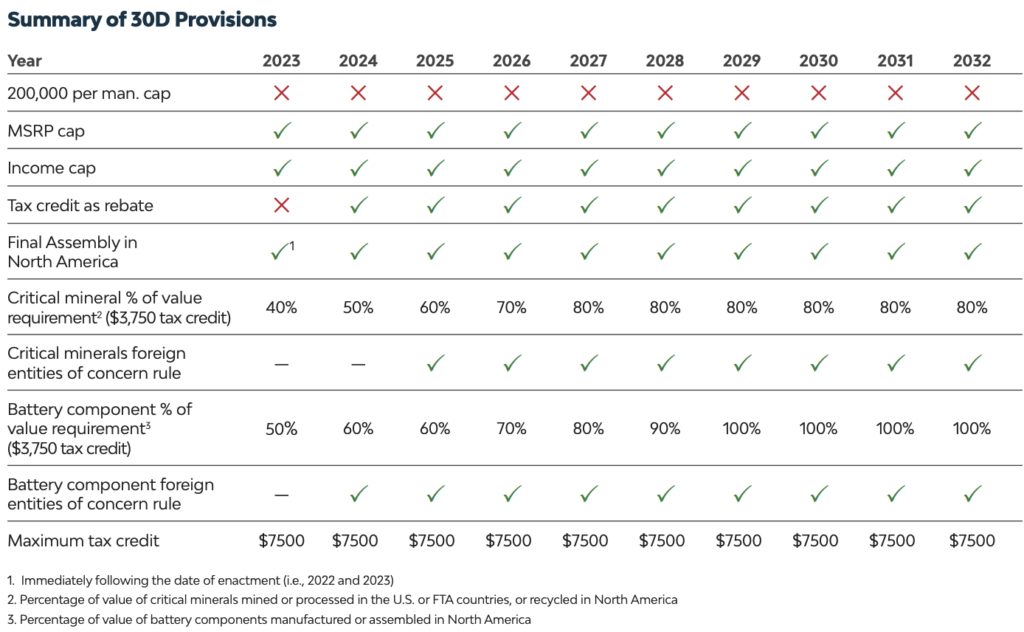

Source : www.npr.org2024 Hybrid Cars Tax Credit The $7,500 EV tax credit will see big changes in 2024. What to : How does the EV tax credit work? When Congress passed the Inflation Reduction Act in 2022, it made big changes to the incentives for electric, hybrid and plug-in hybrid vehicles. Now called the . The list was derived from the latest expanded and modified electric vehicle tax credit regulations. There are loads of hybrid vehicles out there that serve as good family vehicles, and here are .

]]>