2024 Form 1040 Schedule Class I To – Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

2024 Form 1040 Schedule Class I To

Source : thecollegeinvestor.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.eduIRS Tax Forms CPE Courses | Learn with myCPE

Source : my-cpe.comBGFS INC | Riverdale IL

Source : m.facebook.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

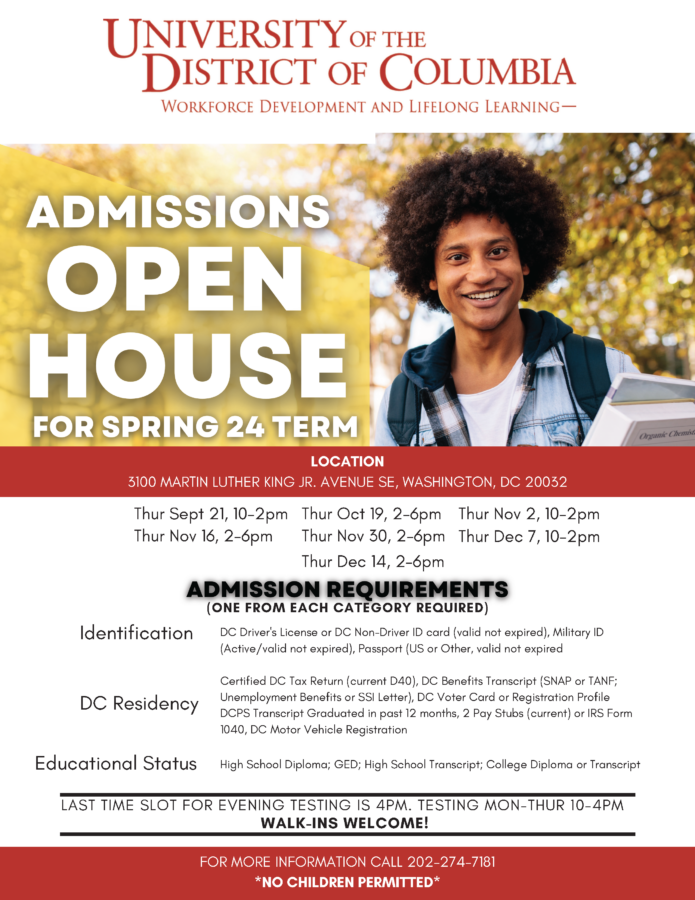

Source : www.investopedia.comHow to Apply and Enroll | University of the District of Columbia

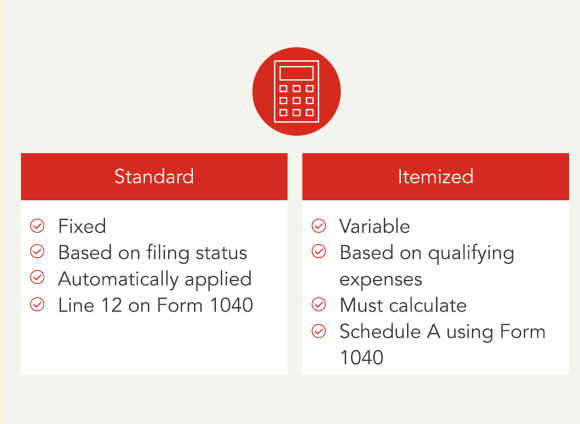

Source : www.udc.eduAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com2024 Form 1040 ES

Source : www.irs.govWhat Are Tax Deductions? A 101 Guide Intuit TurboTax Blog

Source : blog.turbotax.intuit.com2024 Form 1040 Schedule Class I To When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: To claim a loss from your small business, you must use Form 1040 as your individual income tax return form and Schedule C to demonstrate the loss. Complete “Part I” of Schedule C to determine . In other words, taxpayers with uncomplicated tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)