2024 Form 1040 Schedule 6 Fillable – If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule D you will need to complete Form 1040 through line 43 to calculate your . Tax season — with its homeowner tax benefits — is one of the few times you may actually get some money out of your house instead of pouring money into it. Owning a house in the .

2024 Form 1040 Schedule 6 Fillable

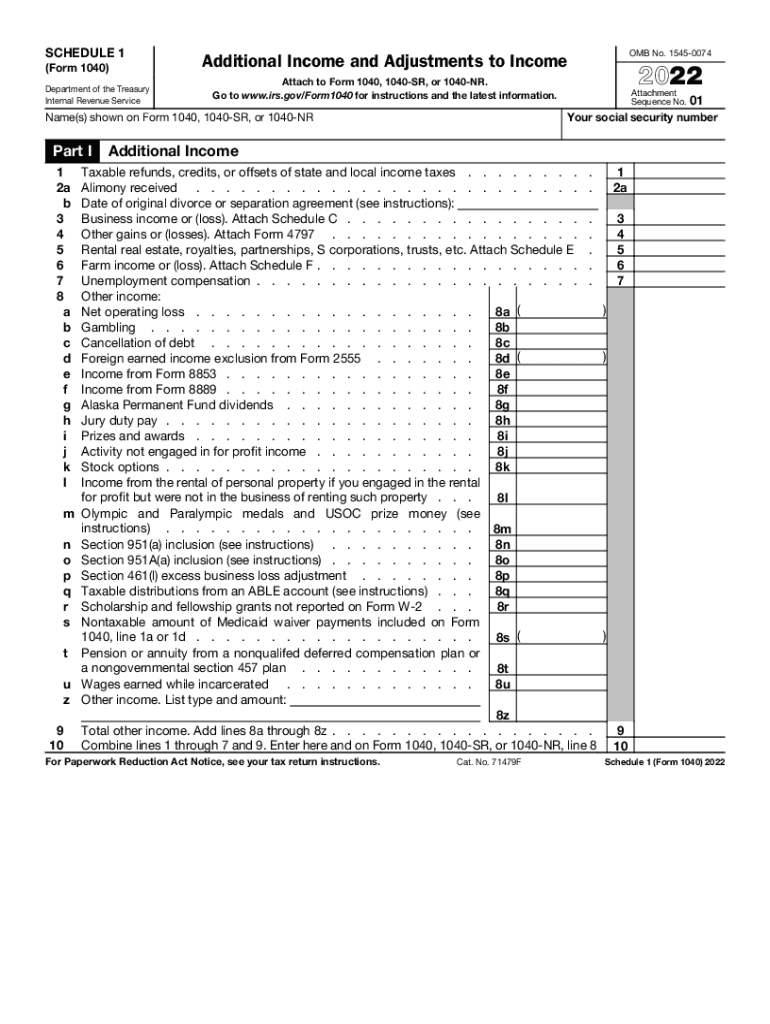

Source : www.irs.gov2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

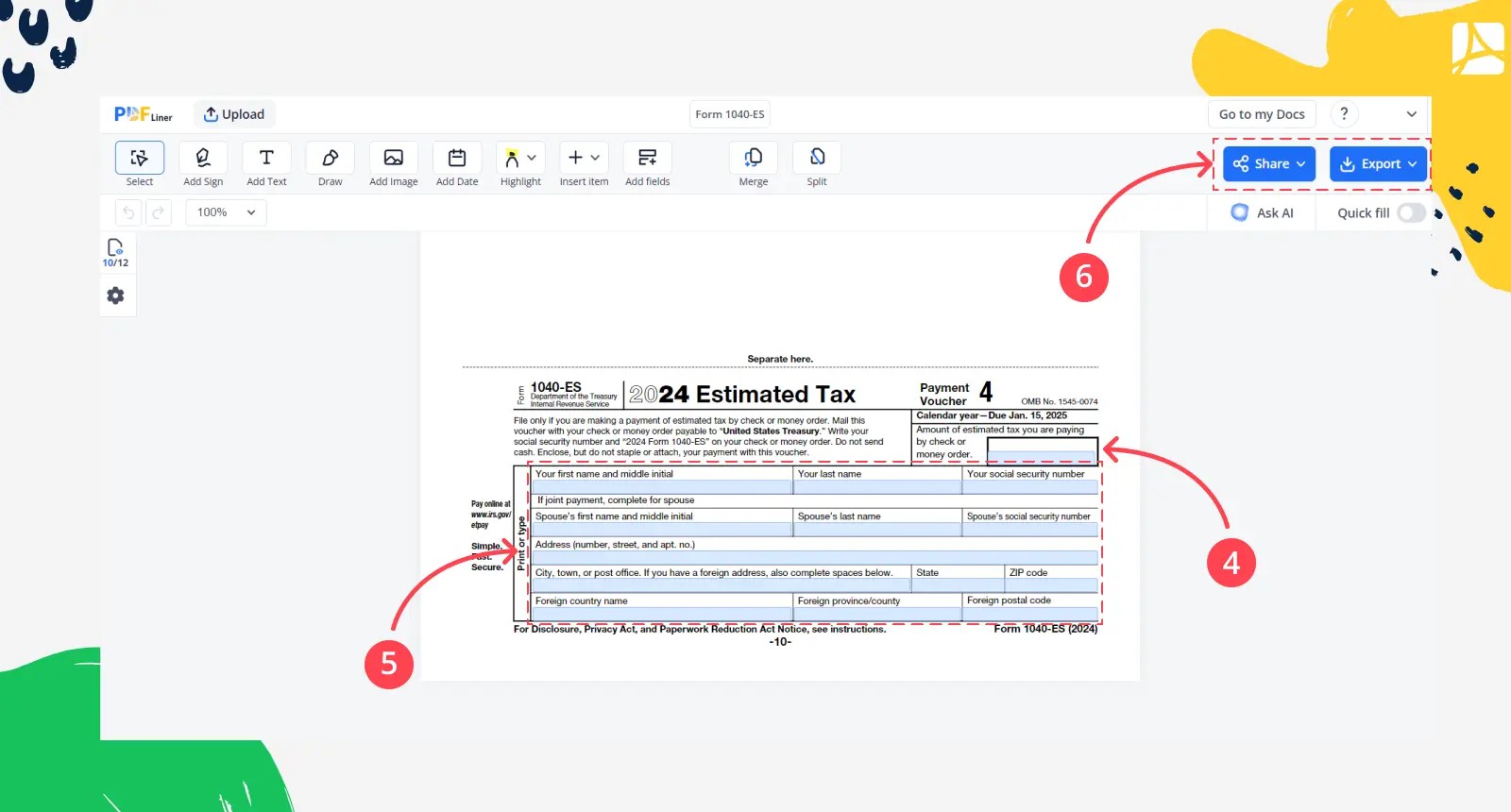

Source : www.irs.govForm 1040 ES (2024), Print and sign form online PDFliner

Source : pdfliner.com1040 (2023) | Internal Revenue Service

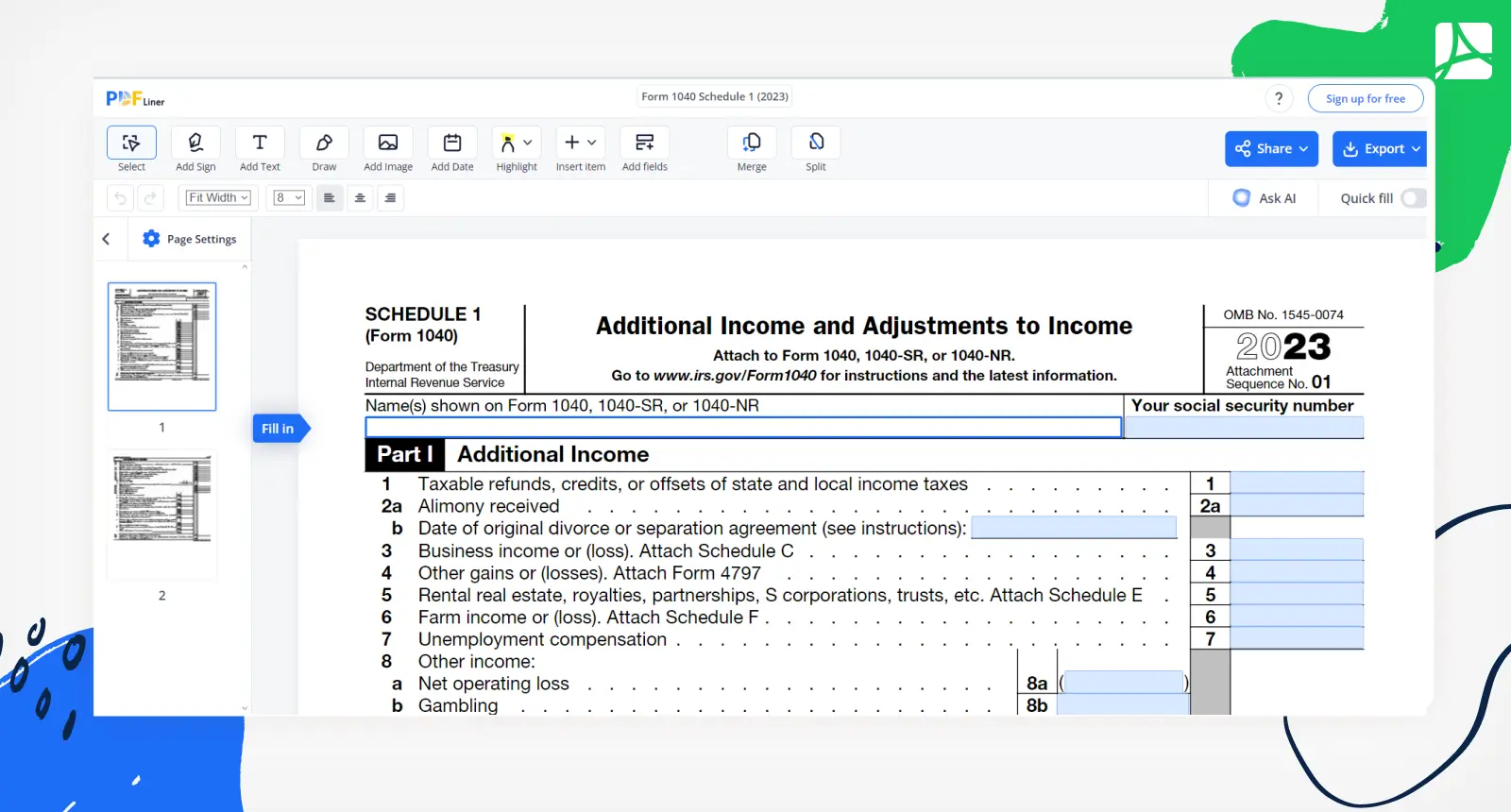

Source : www.irs.govForm 1040 Schedule 1: fill blank online — PDFliner

Source : pdfliner.com1040 (2023) | Internal Revenue Service

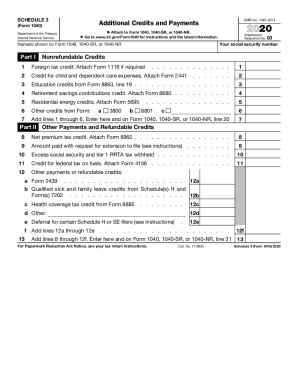

Source : www.irs.govIRS 1040 Schedule 3 2020 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com2024 Form 1040 Schedule 6 Fillable 1040 (2023) | Internal Revenue Service: Margin loan rates from 5.83% to 6.83%. Form 1040 is tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)